Futures vs. Cash Market Trading: Key Differences Explained

At Olympic, we primarily operate in the cash market, also known as the spot market, where lumber is bought and sold for delivery and consumption. However, we also trade in the futures market. It’s essential to understand how the cash market compares to the futures market and how the two are interconnected.

Hopefully, after reading this blog, you’ll have a better understanding of the differences in futures vs cash market trading, and how they work together.

What is Cash Market Trading?

The cash market, also called the spot market, is where physical goods are bought and sold daily, for immediate delivery and payment. In the lumber industry, this means actual truckloads or railcars of lumber are traded between buyers and sellers, with agreed-upon prices and delivery timelines.

At Olympic, this is the core of what we do. We work directly with mills, reload centers(1), and customers to move real product. The deals we make are for physical lumber that is on the ground or will be delivered on an agreed date. There’s no guessing or betting on future prices; cash market trades are based on today’s supply, demand, and availability.

Some key considerations when buying and selling lumber in the cash market are the species, grades, sizes, and quantities of lumber.

An example of a cash market trade would be:

A customer in Calgary needs two truckloads of 2x4 16' SPF lumber(2) for a project starting next week. They reach out to Olympic for a quote. One of our traders checks availability with a mill that has inventory ready to ship and negotiates a price of $550/MBF, FOB mill(3).

The customer agrees, and the order is confirmed with the following details:

- Product: 2x4 16' SPF

- Volume: 2 truckloads

- Price: $550/MBF

- Delivery: FOB mill, shipping out within 5 days

The deal is done, real product, real delivery, and payment terms agreed upon between buyer and seller. That’s a cash market trade.

What is Futures Market Trading?

The futures market is a financial marketplace where buyers and sellers trade contracts based on the expected future price of a product, like lumber, rather than the physical product itself.

Unlike the cash market, where actual lumber changes hands, futures contracts are agreements to buy or sell a set amount of lumber at a predetermined price on a future date. These contracts are traded electronically, primarily through the Chicago Mercantile Exchange (CME).

Lumber futures trade for six delivery months throughout the year. These months help structure pricing and hedging timelines across the industry. The months are: January, March, May, July, September, and November.

A futures contract is for a particular type, species, tally, and grade of lumber. Specifically, the LBR lumber futures contract refers to:

- 27,500 MBF

- R/L #2&Btr 2x4 delivered to Chicago (4)

- SPF (stamped SPF), Douglas Fir, Fir Larch, and Hem Fir

At Olympic, we trade in the futures market as a risk management tool to hedge against price movements in the cash market. This helps us protect our positions, manage exposure, and stay competitive. All of our traders trade in the cash market and use futures as a tool to mitigate risk.

An example of a futures hedge trade would be:

A customer in Edmonton commits to buying ten truckloads of 2x4 14' SPF lumber from Olympic, with delivery scheduled three months from now. The current cash market price is $600/MBF, and both the customer and Olympic want to lock in today’s price to avoid the risk of major price swings.

To hedge the risk of the market moving against us over the next three months, the Olympic trader, who does not yet own the physical wood, sells CME lumber futures contracts that align with the expected delivery month at $600/MBF. This locks in today's price while the trader waits to buy the lumber in the future.

Here are the trade details:

- Product: 2x4 14' SPF (physical lumber)

- Volume: 10 truckloads

- Cash Price: $600/MBF (price locked in with customer today)

- Futures Action: Sell CME lumber futures contracts at $600/MBF for the delivery month, three months out.

- Delivery: To the customer in Edmonton, three months from now.

Over the next 90 days, if lumber prices fall, the futures position gains value, offsetting the drop in the physical market. If prices rise, the futures contract loses value, but Olympic benefits from the stronger cash market.

Once the trader buys the physical lumber, typically closer to the delivery window, they will close out the futures position. This means buying back the same number of futures contracts they originally sold, which cancels out the position and locks in the gain or loss. At that point, the hedge is complete.

Key Differences Between Cash and Futures Market Trading:

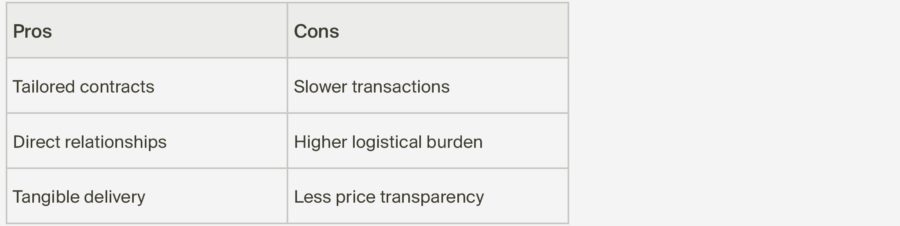

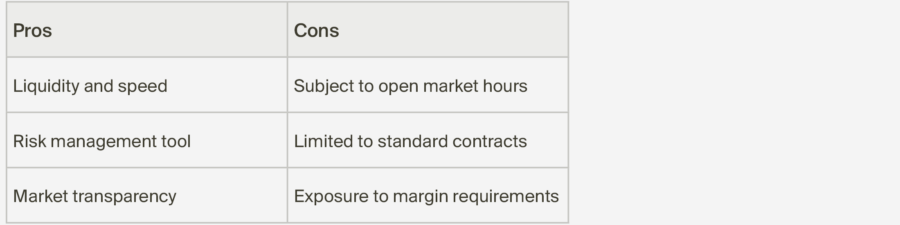

Pros and Cons:

Cash

Futures

The Connection Between the Two Markets

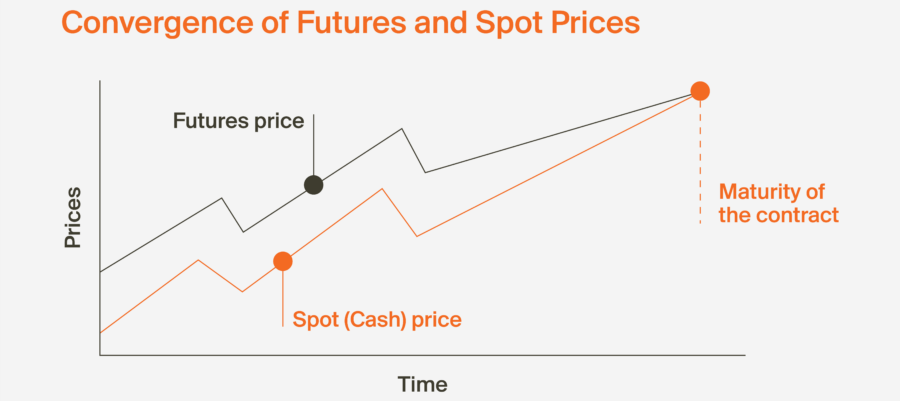

Price Convergence

- As the delivery date of a futures contract approaches, the futures price converges with the cash price.

- This happens because on the last trading day of a contract, the offering on the cash market and the futures market are similar for SPF #2&Btr 2x4. Increased demand for the cheaper of the two options forces the price up, while decreased demand for the more expensive market brings the price down to convergence.

Price Discovery

- The futures market often leads price discovery, meaning it can reflect expectations about future supply and demand conditions for lumber before the cash market does.

- Cash market participants (like sawmills or lumber yards) use futures prices as a reference.

Hedging Tool

- Lumber producers, wholesalers, and retailers use the futures market to hedge against price fluctuations in the cash market.

Conclusion

Understanding the differences between the cash and futures markets is essential for navigating the lumber industry. While the cash market is grounded in the day-to-day reality of moving physical wood, the futures market offers tools to manage risk, anticipate trends, and plan ahead.

Both markets serve different purposes but are deeply connected. Futures trading helps bring transparency, manage volatility, and guide long-term decision-making, while the cash market delivers the lumber that builds homes, businesses, and communities.

By understanding how these markets interact, our customers can make smarter, more informed buying decisions today and for the future.

Check out our derivatives section for more information! Reliable Wood Supplier Operations - Olympic Industries

Contact us today olympicind.com/contact

Glossary

(1) Reload center - A reload center is a facility designed for the transfer of lumber and panel products between different modes of transportation, such as trucks and railcars. It serves as an intermediate point where materials are offloaded, optionally stored as inventory, and then reloaded for shipment to their final destination. Reload centers address the logistical challenges posed by the vast distances and multiple points of origin involved in transporting these products across North America.

(2) 2x4 16' SPF lumber - 2x4 16' SPF lumber is a dimensional lumber product that is a nominal 2 inches thick by 4 inches wide and is 16 feet in length. It is made from Spruce-Pine-Fir (SPF), a grouping of softwood species commonly found in North America.

(3) $550/MBF, FOB mill - This tells us that it will cost $550 per metric board foot of lumber. FOB mill stands for free on board, meaning that the seller's obligation ends once the lumber has been loaded onto the buyer's preferred means of transportation.

(4) R/L #2&Btr 2x4 delivered to Chicago - refers to a standardized lumber product specification used in the trading of CME lumber futures contracts. The full term can be broken down as follows:

- R/L: Random Length, meaning the lumber pieces come in varying lengths (typically between 8 to 20 feet), as opposed to a fixed length.

- #2&Btr: Number 2 and Better, a lumber grade classification under the National Lumber Grades Authority (NLGA) or Western Wood Products Association (WWPA), indicating structural lumber with allowable knots and imperfections, suitable for general construction use.

- 2x4: Refers to the nominal dimensions of the lumber—approximately 2 inches by 4 inches (actual size typically 1.5" x 3.5").

- Delivered to Chicago: Indicates the delivery location basis for the lumber futures contract. In the CME contract, delivery is freight-on-board (FOB) the destination zone around Chicago, which acts as a pricing reference point.